Let’s be honest, most people who bet on sports don’t actually know whether they have an edge. They say they do. They feel like they do. They’ve “been watching the league for years.” But unless you can quantify your advantage over the price being offered, you’re not operating with an edge. You’re operating with hope. An edge in sports betting isn’t about confidence, insider vibes, or being on a heater. It’s about one thing:

Are your probability estimates better than the market’s?

If the answer is no, the sportsbook has the advantage. If the answer is yes even by a few percentage points you have something real. And over time, that difference compounds.

What Does “Edge” Actually Mean?

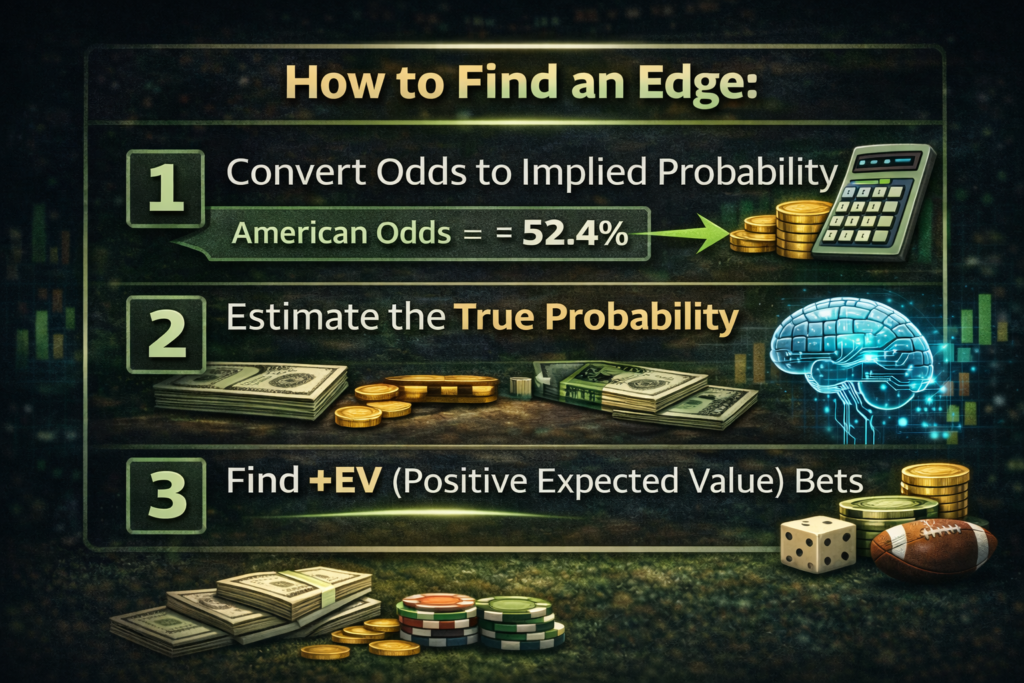

An edge exists when your calculated probability of an outcome is higher than the probability implied by the sportsbook’s odds.

If a sportsbook prices a bet as a 52% event, and you believe (based on data, not instinct) that it actually wins 57% of the time, your edge is 5%.

You are buying something undervalued.

Everything else in betting flows from this concept.

The Math Behind an Edge

Let’s say a team is priced at -110.

Break-even probability at -110 is:

52.38%

If your projection says the true win probability is 57%, your edge looks like this:

| Metric | Value |

|---|---|

| Sportsbook implied probability | 52.38% |

| Your estimated probability | 57% |

| Edge | 4.62% |

That difference may look small but in betting, small is powerful.

Over hundreds of bets, a consistent 3–5% edge is the difference between grinding profit and funding the sportsbook’s marketing department.

Edge and Expected Value

An edge is simply another way of saying you have positive expected value (EV).

If the average long-term return on a bet is positive, you have an edge.

If it’s negative, you don’t.

Short-term wins mean nothing. Long-term expectation is everything.

Where Edges Actually Come From

This is where most content online gets shallow. Edges don’t appear magically. They come from structural advantages.

1️⃣ Analytical Precision

The most sustainable edge is analytical.

Not trends. Not narratives. Not “gut feel.”

It comes from:

- Quantifying pace shifts

- Adjusting for lineup volatility

- Identifying matchup inefficiencies

- Modeling regression properly

- Understanding how variance skews recent results

Serious bettors rely on structured probability models. That’s also why AI-driven platforms like TheOver.ai focus on statistical mispricing particularly in totals markets, where pace and efficiency projections can diverge from public perception.

The goal isn’t prediction. It’s probability accuracy.

2️⃣ Market Timing

Markets move for reasons.

Injuries get confirmed. Sharps hit early. Numbers adjust.

If you consistently capture better prices than the closing line, that’s evidence your estimates are sharper than the market at open.

We explore this concept further in What Is Closing Line Value (CLV)? because beating the closing number is one of the strongest signals that your edge is real.

3️⃣ Price Sensitivity

Most bettors obsess over sides but ignore pricing differences.

A -110 vs -105 difference looks trivial. It’s not.

Over 1,000 bets, consistently shaving 5 cents off juice can swing ROI dramatically. Professional bettors treat price like traders treat spreads because small friction compounds.

4️⃣ Risk Allocation Discipline

Here’s something rarely discussed:

You can have an edge and still go broke.

If your bet sizing doesn’t align with edge magnitude, variance will overwhelm you.

A 2% edge doesn’t justify aggressive exposure. Professionals scale bets relative to advantage not confidence.

We break this down in How Much Should You Bet Per Wager?, because edge without bankroll structure is just volatility.

What a Realistic Edge Looks Like

Let’s reset expectations.

| Edge Size | Reality |

|---|---|

| 1–2% | Strong in efficient markets |

| 3–5% | Elite modeling |

| 8%+ | Rare in major leagues |

| 15%+ | Likely miscalculated |

Markets like the NFL are highly efficient. Your edge, if it exists, is thin.

That’s normal. Thin edges scale.

The Invisible Opponent: Vig

Most bettors misunderstand this:

If you’re betting at -110 and winning 50% of the time, you are not breaking even.

You’re losing.

The sportsbook’s edge the vig requires you to exceed 52.38% just to stand still.

That’s why having a measurable edge matters. Without it, the house margin quietly erodes your bankroll.

Edge vs Variance

A lot of bettors abandon sound strategy during losing streaks.

Even with a 57% true win rate, you lose 43% of the time.

Losing 7 of 10 doesn’t disprove edge.

Winning 7 of 10 doesn’t prove it.

Edge reveals itself over hundreds of bets not weekends.

If you don’t understand variance, you’ll sabotage your own advantage.

Example: Totals Market Edge

Let’s say an NBA total opens at 221.5.

Your projection model outputs 226.0 based on:

- Elevated projected pace

- Defensive lineup downgrade

- 3-point attempt rate trend

- Recent offensive efficiency normalization

Implied probability of the Over at -110: 52.38%

Your projected probability: 58%

Edge: 5.62%

That’s a measurable mispricing. Not because you “like the over” but because the probability math supports it.

How to Validate That Your Edge Is Real

Ask yourself:

- Are you consistently beating the closing line?

- Is your ROI positive over 300–500 bets?

- Are you quantifying probability, not guessing?

- Are your results aligned with expected variance?

If you can’t answer those clearly, your edge may be perceived not proven.