The Kelly Criterion is often described as the “optimal” betting strategy. It is praised by professional gamblers, quantitative investors, and bankroll management experts as the most mathematically efficient way to size bets when you have an edge.

But optimal does not mean simple.

And it certainly does not mean risk-free.

The Kelly Criterion can accelerate bankroll growth when used correctly and magnify mistakes when used carelessly. Understanding both its strengths and weaknesses is essential before applying it to real money.

What the Kelly Criterion Is Designed to Do

The Kelly Criterion is a formula used to determine how much of your bankroll to wager on a bet when you believe you have positive expected value. Instead of betting a flat amount or guessing stake size, Kelly calculates the precise percentage of your bankroll that maximizes long-term growth.

It scales bet size based on edge. A larger edge leads to a larger recommended wager. A smaller edge leads to a smaller one. If there is no edge, Kelly recommends no bet at all.

Its purpose is capital optimization not prediction improvement.

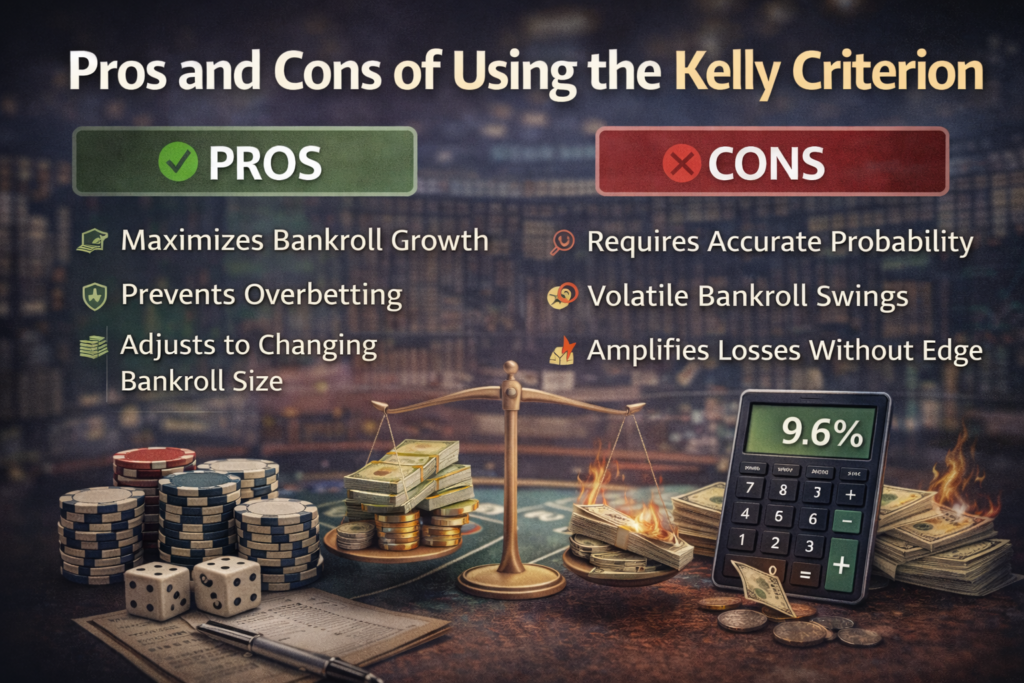

The Pros of Using the Kelly Criterion

1. Maximizes Long-Term Bankroll Growth

The primary advantage of the Kelly Criterion is that it mathematically maximizes logarithmic bankroll growth over repeated bets. Unlike flat betting systems, which treat all wagers equally, Kelly adjusts bet size proportionally to advantage.

When probability estimates are accurate, no other staking method produces faster long-term capital growth without increasing risk of ruin.

For serious bettors operating with measurable edge such as those quantifying probability through structured modeling this efficiency matters.

2. Prevents Overbetting

One of the most common mistakes in sports betting is risking too much on perceived “strong” plays. Kelly imposes discipline by tying bet size directly to edge magnitude rather than emotion.

If the calculated edge is small, the recommended stake will also be small. This prevents reckless exposure during moments of confidence or excitement.

In this sense, Kelly acts as a built-in emotional control system.

3. Automatically Adjusts for Changing Bankroll Size

Because Kelly calculates bet size as a percentage of bankroll, staking naturally scales up during growth periods and scales down during losing streaks.

This dynamic adjustment protects against total bankroll collapse and ensures that bet sizing remains proportionate over time.

Flat betting does not adapt this way. Kelly does.

4. Aligns Risk With Mathematical Edge

Kelly forces bettors to quantify edge before risking money. You cannot apply the formula without estimating true probability and comparing it to implied probability.

This reinforces disciplined decision-making. It connects edge identification discussed in detail in What Is an Edge in Sports Betting? directly to capital allocation.

The formula does not create edge. It optimizes it.

5. Reduces Risk of Ruin Compared to Aggressive Staking

While Kelly can be volatile, it still provides significantly more protection than arbitrary aggressive staking. Betting 20–30% of bankroll on individual wagers exposes bettors to rapid collapse.

Kelly sizing, when based on realistic edge estimates, reduces that catastrophic risk while preserving growth potential.

The Cons of Using the Kelly Criterion

1. It Requires Accurate Probability Estimation

The biggest weakness of Kelly is its dependency on accurate inputs.

If your probability estimate is inflated, your stake size will also be inflated. Even small errors in edge estimation can result in meaningful overbetting.

For example, believing you have a 6% edge when you actually have a 2% edge dramatically changes recommended bet size. That difference increases volatility and drawdown risk.

Kelly is only as reliable as your model.

2. Full Kelly Is Highly Volatile

Full Kelly staking often produces significant bankroll swings.

Even with a real edge, bettors may experience:

- 20% to 40% drawdowns

- Extended losing streaks

- Psychological stress from capital fluctuations

Mathematically optimal growth does not equal emotionally comfortable growth.

This is why many professionals use fractional Kelly instead.

3. It Can Amplify Losses if You Don’t Have an Edge

Kelly assumes positive expected value.

If you do not have a true edge, Kelly does not protect you it accelerates losses.

Because the formula scales bet size relative to perceived edge, inaccurate assessments can magnify mistakes.

Without structured probability modeling and disciplined tracking, Kelly becomes dangerous.

4. Psychological Pressure Is Real

Betting 8% or 10% of bankroll which Kelly might recommend for strong edges can feel aggressive during real money drawdowns.

Many bettors abandon Kelly during losing streaks, defeating the purpose of using it in the first place.

If you cannot stick to the process through volatility, the theoretical advantage becomes irrelevant.

5. Markets Are Not Perfectly Predictable

Sports betting markets are highly efficient. Edges are often small 1% to 4% in strong markets.

When edges are thin, full Kelly recommendations may still feel large relative to risk tolerance.

Modern bettors who rely on AI-driven models, including systems like TheOver.ai that focus on quantifying totals inefficiencies, still operate within probabilistic uncertainty. Even the best models produce error margins.

Kelly does not eliminate model uncertainty it assumes confidence in it.

Full Kelly vs Fractional Kelly

Because of volatility concerns, many professionals reduce exposure by using fractional Kelly.

Common variations include:

- Half Kelly (50% of calculated size)

- Quarter Kelly (25% of calculated size)

Fractional Kelly sacrifices some theoretical growth rate in exchange for smoother bankroll performance and reduced drawdowns.

For most bettors, fractional Kelly offers a more practical balance between mathematical optimization and psychological sustainability.

Kelly Criterion vs Flat Betting

Flat betting involves wagering the same amount on every bet regardless of edge size. It is simple and psychologically stable but inefficient from a growth standpoint.

Kelly adjusts stake size based on advantage. This produces faster compounding when edges are present but introduces greater short-term volatility.

The decision between them depends on:

- Confidence in probability estimation

- Risk tolerance

- Emotional discipline

- Sample size expectations

When Should You Use Kelly?

The Kelly Criterion makes the most sense when:

- You can quantify true probability consistently

- You track expected value across large samples

- You understand variance

- You treat bankroll as capital rather than entertainment money

It is less appropriate when:

- Betting decisions are intuitive

- Edge is not measurable

- Emotional discipline is inconsistent

- Tracking is absent

Kelly is not a shortcut to profitability. It is a capital allocation system for structured bettors.

Final Verdict: Is the Kelly Criterion Worth Using?

The Kelly Criterion is one of the most mathematically sound staking methods available. It maximizes long-term growth and enforces disciplined bet sizing.

However, it demands precision. Without reliable edge estimation, Kelly becomes a volatility amplifier rather than a growth optimizer.

For advanced bettors with quantifiable advantage, Kelly particularly fractional Kelly can significantly improve long-term capital efficiency.

For undisciplined bettors, it accelerates losses.

Like most tools in sports betting, it does not create edge.

It only manages it.