Public betting percentages are one of the most misunderstood concepts in sports betting.

You’ve likely seen them displayed on sportsbook dashboards or analytics sites:

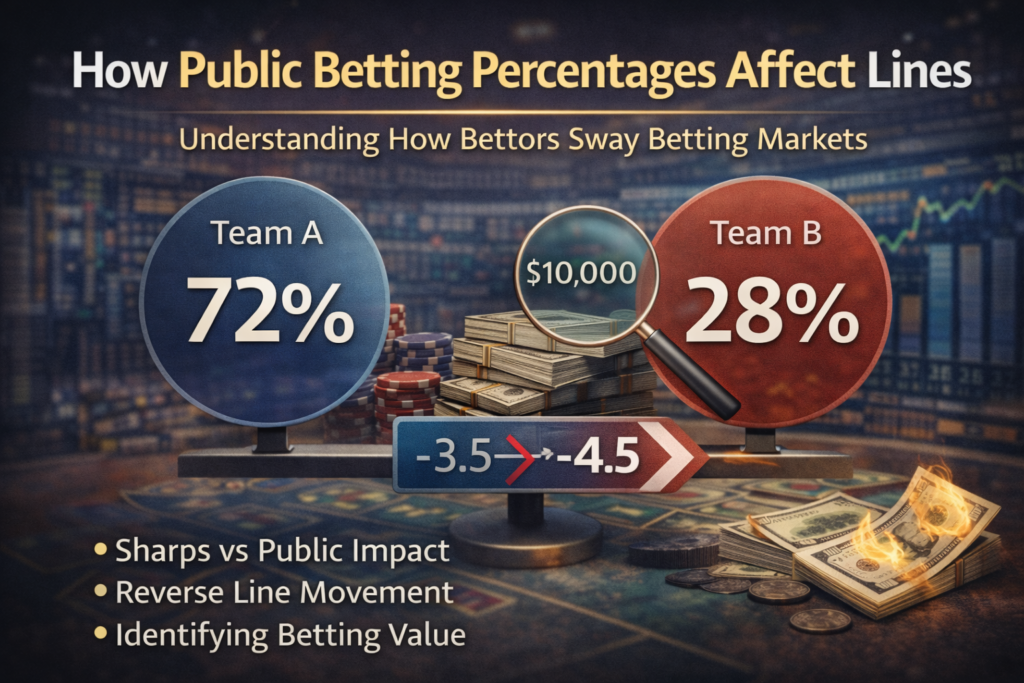

- 72% of bets on Team A

- 81% of money on the Over

- 65% of tickets on the favorite

Many bettors assume that these percentages directly determine line movement. Others assume sportsbooks adjust lines simply to balance action.

Both assumptions are incomplete.

Public betting percentages influence markets but not in the simplistic way most people believe.

Understanding how they truly affect lines requires understanding how sportsbooks manage risk, how sharp money interacts with public money, and how pricing markets actually function.

What Are Public Betting Percentages?

Public betting percentages represent the proportion of total bets (tickets) placed on one side of a wager.

For example:

| Side | % of Tickets |

|---|---|

| Team A | 72% |

| Team B | 28% |

This tells you how many individual wagers were placed on each side not necessarily how much money.

Some platforms also display percentage of money, which reflects the total handle rather than ticket count.

The distinction is critical:

- Ticket percentage often reflects public activity.

- Money percentage can reflect larger, sharper wagers.

Public percentages show distribution not value.

The Common Myth: Sportsbooks Move Lines to Balance Action

The idea that sportsbooks simply move lines to achieve 50/50 betting splits is outdated and oversimplified.

Modern sportsbooks do not aim to perfectly balance action on every game.

Instead, they aim to:

- Price lines efficiently

- Protect against sharp exposure

- Maintain margin

- Adjust to informed money

If 75% of tickets are on one side, sportsbooks do not automatically move the line unless the risk profile demands it.

Balancing action is secondary to pricing accuracy.

When Public Betting Percentages Actually Move Lines

Public betting percentages affect lines under certain conditions.

1. When Public Volume Is Large Enough

In high-profile games such as NFL playoffs or major college football matchups public money can be substantial. If large volumes accumulate on one side, sportsbooks may adjust lines to manage exposure.

However, even then, adjustments are often modest unless supported by sharper action.

2. When Public and Sharp Money Align

If both public bettors and sharp bettors are on the same side, line movement can be aggressive.

This creates momentum.

For example:

- 70% of tickets on the favorite

- 75% of money on the favorite

- Line moves from -3 to -4.5

In this case, the move is likely influenced more by sharp confirmation than by public volume alone.

3. When Public Sentiment Influences Market Perception

Public-heavy narratives can create temporary distortions.

For example:

- A team wins by 20 points on national television.

- Casual bettors overreact.

- Betting percentages spike heavily toward that team the following week.

Early sharp money may push against that sentiment if the number becomes inflated.

Public percentages can indirectly create opportunity by pushing lines away from true probability.

When Public Percentages Do NOT Move Lines

Many bettors assume that high public betting percentages guarantee line movement.

That is incorrect.

If 80% of tickets are on one side but the average bet size is small, sportsbooks may tolerate that imbalance.

Small public bets do not carry the same weight as larger informed wagers.

This is why analyzing ticket percentage without money percentage is incomplete.

Reverse Line Movement: A Key Signal

Reverse line movement occurs when:

- Majority of tickets are on one side

- Line moves in the opposite direction

Example:

| Metric | Value |

|---|---|

| 70% of tickets | On Team A |

| Line movement | From -3 to -2.5 |

This suggests larger, sharper wagers are influencing the market despite public majority.

Reverse line movement is often a stronger signal than raw betting percentages.

Public Betting and Market Efficiency

Sports betting markets are dynamic pricing systems.

Public betting percentages represent only one data input.

Markets respond more heavily to:

- Sharp money

- Injury information

- Model-driven wagering

- Market origin pricing

- Liquidity conditions

Public betting percentages matter most when they materially affect risk exposure.

They do not independently dictate pricing.

Understanding this distinction prevents misinterpretation.

Why Public Betting Percentages Can Create Opportunity

While sportsbooks do not blindly fade the public, public sentiment can distort perception.

For example:

- Public overvalues favorites

- Public prefers overs in totals markets

- Public reacts emotionally to recent performance

This can cause numbers to drift slightly away from fair value, particularly in high-visibility games.

Structured bettors analyze whether that drift creates positive expected value rather than automatically fading public action.

Understanding expected value is essential here. If you’re unfamiliar with how edge is created, review What Is an Edge in Sports Betting?

Public Betting Percentages in Totals Markets

Totals markets are particularly sensitive to public behavior.

Public bettors tend to prefer overs because:

- Overs are more entertaining

- Points feel intuitive

- Unders require patience

In games with heavy public over percentages, totals may inflate slightly. However, market efficiency in major leagues often limits how extreme these adjustments become.

Advanced modeling including pace and efficiency projections such as those used in structured systems like TheOver.ai focuses on identifying when totals move beyond statistical justification.

Public percentages alone are not sufficient. Probability modeling must confirm value.

How Professionals Use Public Betting Data

Serious bettors do not treat public percentages as betting signals by themselves.

Instead, they use them as context.

They ask:

- Is line movement aligned with public money?

- Is there reverse line movement?

- Is the current price justified by true probability?

- Has public sentiment inflated the number?

Public betting data becomes one variable within a larger analytical framework.

The Difference Between Fading the Public and Finding Value

There is a common belief that fading public bettors is profitable. Blindly betting against high public percentages is not a strategy. Sometimes the public is correct.

The correct approach is:

- Evaluate implied probability

- Estimate true probability

- Determine if pricing reflects emotional distortion

If public influence creates mispricing, value exists. If not, fading simply becomes another emotional reaction.

Final Takeaway

Public betting percentages influence lines but indirectly. They affect perception, liquidity, and exposure. They sometimes contribute to line movement. They occasionally create inefficiencies. But they do not independently control markets. Sportsbooks move lines primarily in response to risk management and sharp money, not public ticket counts alone. Understanding this prevents common betting mistakes and allows public data to be used intelligently rather than emotionally. Public percentages are information. They are not edge. Edge still requires probability.