In sports betting, few concepts are as important yet as misunderstood as Closing Line Value, commonly referred to as CLV. While many bettors focus on whether a single bet wins or loses, experienced bettors evaluate performance over time using CLV. It is widely regarded as one of the most reliable indicators of long term betting skill.

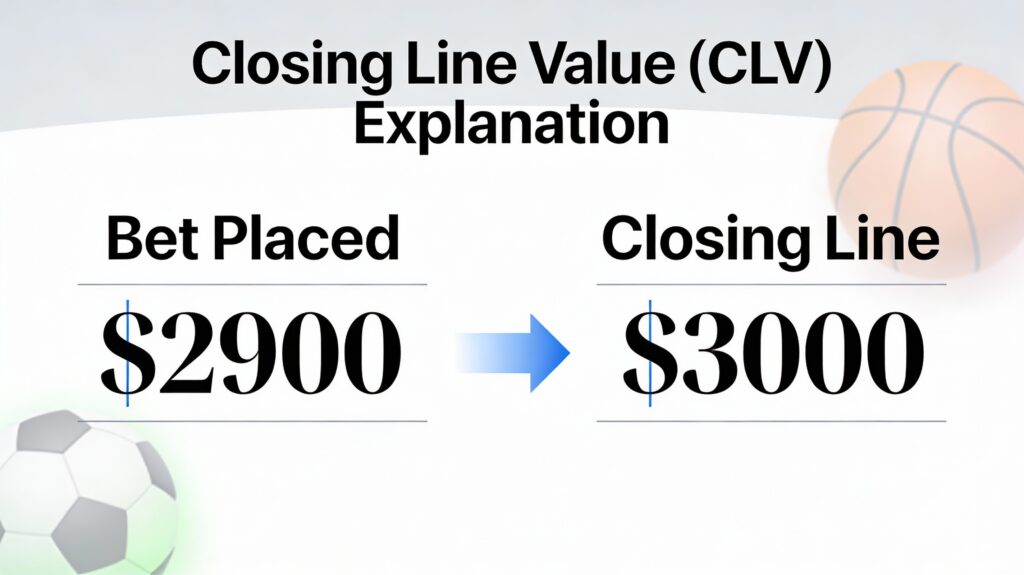

Closing Line Value measures whether you consistently beat the market. In simple terms, it compares the odds you received when placing a bet to the odds available at market close. If your odds are better than the closing odds, you have positive CLV. If they are worse, you have negative CLV.

To fully understand CLV, it helps to first understand how sportsbooks set betting lines, how odds reflect probability, and why market timing matters.

Understanding the Closing Line

Before defining CLV, it is important to understand the concept of the closing line.

The closing line is the final set of odds or point spread offered by a sportsbook just before an event begins. At that moment, the line reflects the combined influence of sharp bettors, public money, updated information, and market consensus. Because of this, the closing line is often considered the most accurate representation of true probability.

For example, if an NBA game opens with Team A at -3 and closes at -5, the market ultimately decided that Team A was stronger than initially expected.

What Is Closing Line Value?

Closing Line Value compares the odds you locked in to the odds available at close.

If you bet at better odds than the closing line, you achieved positive CLV. If you bet at worse odds, you had negative CLV.

CLV does not measure whether a single bet wins or loses. Instead, it evaluates the quality of your betting decisions.

Simple Example

You place a bet on a team at +150.

By game time, the same team is available at +120.

You locked in a better price than the market ultimately offered. That is positive CLV.

Even if the bet loses, the decision itself was strong.

Why Closing Line Value Matters

CLV matters because it separates luck from skill.

Sports betting involves variance. Even well researched bets can lose in the short term. CLV helps bettors determine whether their process is sound over the long run.

This concept ties closely to expected value (EV). Bets that consistently beat the closing line tend to have positive expected value over time.

Key Reasons CLV Is Important

- It reflects market beating ability

- It removes short term variance from evaluation

- It correlates strongly with long term profitability

- It shows whether you consistently find value

Professional bettors and sharp syndicates track CLV closely because beating the closing line repeatedly is extremely difficult without an edge.

CLV vs Winning Bets

A common misconception is that winning bets automatically indicate skill. This is not always true.

A bettor can win several bets by chance while consistently taking poor prices. Over time, this approach usually fails.

On the other hand, a bettor can lose short term while consistently beating the closing line. In most cases, profitability follows if discipline is maintained.

CLV focuses on decision quality, not short term outcomes.

How Closing Line Value Is Calculated

CLV can be expressed in different ways depending on the bet type.

Moneyline CLV

For moneyline bets, CLV is calculated by comparing the odds you received to the closing odds.

Example:

Your bet: +180

Closing line: +150

You captured value because the implied probability increased against your position.

Point Spread CLV

For point spreads, CLV measures how many points of advantage you gained.

Example:

Your bet: +4.5

Closing line: +3

You gained 1.5 points of CLV.

This is significant in sports like football and basketball where key numbers matter.

Totals CLV

For totals, CLV measures how much the total moved after your bet.

Example:

Your bet: Over 47

Closing line: Over 49

You beat the market by two points, indicating strong CLV.

Why the Closing Line Is So Important

The closing line reflects the most informed version of the market.

By the time a line closes, sportsbooks have absorbed action from professional bettors, adjusted for public betting, and accounted for last minute information such as injuries and weather.

Because of this, beating the closing line consistently is extremely difficult without accurate analysis.

This is why CLV is widely accepted as a benchmark for betting skill.

Positive vs Negative CLV

Positive CLV

Positive CLV means you consistently place bets at better odds than the market consensus. This suggests strong timing, accurate analysis, or access to valuable information.

Over time, positive CLV bettors are far more likely to be profitable.

Negative CLV

Negative CLV means you are betting at worse prices than the market. This often indicates late betting, overreaction to public narratives, or poor line shopping.

Negative CLV does not guarantee losses in the short term, but it is a warning sign for long term results.

Timing and CLV

Timing plays a major role in CLV.

Early bettors often capture value before sharp money moves the line. Late bettors may benefit from confirmed news but risk paying inflated prices driven by public action.

Understanding when markets move and why they move is essential for improving CLV.

Common Misunderstandings About CLV

One common mistake is assuming CLV guarantees profit on every bet. It does not. CLV is a long term indicator, not a short term prediction tool.

Another misconception is believing that CLV only applies to pregame bets. While most CLV analysis focuses on pregame markets, similar concepts can apply to certain live betting situations as well.

Some bettors also confuse CLV with line movement alone. While related, CLV is personal. It measures your price versus the closing price, not just how the line moved overall.

How to Improve Your Closing Line Value

Improving CLV requires discipline and structure.

- Bet earlier when markets are softer

- Shop lines across multiple sportsbooks

- Avoid chasing public narratives close to game time

- Focus on numbers, not opinions

- Track your bets consistently

Using analytical tools can significantly improve your ability to identify value before the market adjusts.

How TheOver.ai Helps Track and Improve CLV

Tracking CLV manually is time consuming and error prone. This is where platforms like TheOver.ai become valuable.

TheOver.ai helps bettors by:

- Tracking odds movement across sportsbooks

- Recording your bet price versus closing price

- Highlighting whether you beat the closing line

- Providing data driven insights into market behavior

By using TheOver.ai, bettors can objectively evaluate their betting performance beyond wins and losses. Over time, this feedback loop helps refine strategy and improve CLV consistency.

CLV and Long Term Profitability

Most professional bettors agree on one principle. If you consistently beat the closing line, profits tend to follow.

CLV is not about predicting outcomes perfectly. It is about placing bets at prices that are better than what the market ultimately considers fair.

Over hundreds or thousands of bets, that edge compounds.

Key Takeaways

- Closing Line Value measures whether you beat the market, not whether a single bet won

- Positive CLV is one of the strongest indicators of long term betting success

- CLV applies to moneylines, spreads, and totals

- Timing, discipline, and line shopping are critical to improving CLV

- Tools like TheOver.ai make CLV tracking accurate and actionable

Final Thoughts

Closing Line Value is not a flashy concept, but it is one of the most important tools for serious bettors. It shifts the focus away from emotional results and toward process, pricing, and discipline.

Bettors who understand and track CLV place themselves on the same analytical foundation used by professionals. With consistent evaluation and the right tools, CLV becomes a powerful guide for building sustainable betting success.